One of Argentine President Milei’s radical reforms was to “take a chainsaw” to rent control laws. Argentina had had some of the most restrictive rent control regimes ever. All of that was abandoned almost over night. Many media outlets noted with glee that rents fell dramatically. Even most economists were surprised by how much supply…

Argentine Rental Market Natural Experiment

Argentine Rental Market Natural Experiment

24 Nov 2025 Leave a comment

in applied price theory, development economics, economics of regulation, growth disasters, history of economic thought, income redistribution, law and economics, property rights, Public Choice, public economics, regulation, rentseeking, transport economics, urban economics Tags: Argentina, rent control

Why No One Likes Land Taxes

21 Nov 2025 Leave a comment

in applied price theory, fiscal policy, macroeconomics, Public Choice, public economics Tags: taxation and investment

Economists and [insert basically every other group of people] often don’t agree. Take, for instance, the recent discussion of price controls. The headline of this opinion piece on the subject in The New York Times literally begins with “Economists Hate This Idea.” Yet voters aren’t so skeptical. (I’m not ready to say the idea has…

Why No One Likes Land Taxes

The Value-Added Tax: A Recipe for More Spending…and More Debt: Part II

12 Nov 2025 Leave a comment

in economic history, fiscal policy, macroeconomics, Public Choice, public economics

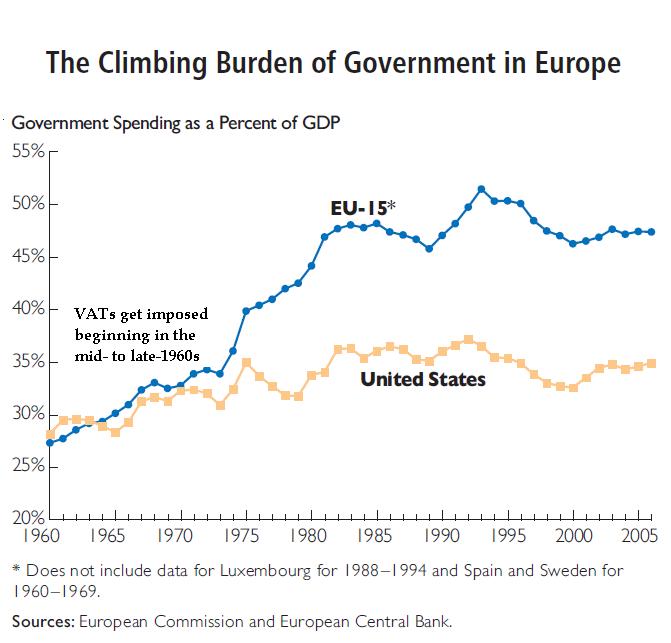

The case against the value-added tax (VAT) is not complicated. Simply stated, this hidden type of national sales tax was a key precursor for the expansion of the European welfare state. As you can see in the chart, the burden of government spending in Europe after World War II was similar to the size of […]

The Value-Added Tax: A Recipe for More Spending…and More Debt: Part II

Does the state need to own houses to help families?

01 Nov 2025 Leave a comment

in applied price theory, economics of bureaucracy, industrial organisation, law and economics, managerial economics, market efficiency, organisational economics, politics - New Zealand, property rights, Public Choice, public economics, urban economics Tags: public housing, state ownership

A good report from the NZ Initiative that looks at whether ownership of state houses is the best way to help low income NZ families with housing. Some key extracts: That $29,000 per unit estimated cost is not the cost of income related rents – they are the same regardless of whether the state or […]

Does the state need to own houses to help families?

Capital gains tax: how Hipkins has abandoned policy soundness for a symbolic gesture

01 Nov 2025 Leave a comment

in fiscal policy, income redistribution, macroeconomics, politics - New Zealand, Public Choice, public economics Tags: taxation and investment

Peter Dunne writes – In 1994 the then Labour Opposition resolved to introduce a new top tax rate of 39 cents in the dollar. The reason for the policy was purely political, not fiscal. Labour was shedding votes to Jim Anderton’s left-wing Alliance at the time and wanted to do something symbolic to staunch the flow. […]

Capital gains tax: how Hipkins has abandoned policy soundness for a symbolic gesture

Part IV: Yes, Taxes Change Behavior

22 Oct 2025 Leave a comment

in applied price theory, fiscal policy, human capital, labour economics, labour supply, macroeconomics, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

There can be honest and constructive debates about the size of government, such as when I cross swords with someone on the left who understands Arthur Okun’s efficiency-equity tradeoff. Another legitimate debate is about the impact of tax policy, specifically whether higher or lower tax rates have big effects or small effects. But to have […]

Part IV: Yes, Taxes Change Behavior

State very expensive landlord

17 Oct 2025 Leave a comment

in applied price theory, economics of bureaucracy, industrial organisation, law and economics, politics - New Zealand, property rights, Public Choice, public economics, urban economics

A report by the New Zealand Initiative shows that the state is a very expensive landlord: Why does the government need to continue owning or managing more than 77,000 housing units, given its poor track record in this area, especially when state assistance can be provided without extensive government ownership? And why does it not […]

State very expensive landlord

Taxes and Growth, Part II

15 Oct 2025 Leave a comment

in applied price theory, economic growth, fiscal policy, macroeconomics, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

I wrote a column about taxes and growth in 2020. Let’s augment that analysis by digging into some details. I decided to address the issue today after seeing a tweet with this helpful summary of how different taxes cause different levels of economic damage (the Tax Foundation also has a table that ranks different taxes, […]

Taxes and Growth, Part II

Is the earned income tax overrated?

09 Oct 2025 Leave a comment

in applied price theory, economics of education, human capital, income redistribution, labour economics, labour supply, occupational choice, Public Choice, public economics, welfare reform Tags: taxation and labour supply

This policy has been so popular with economists on a bipartisan basis, yet a recent piece in ReStud raises some doubts, as the wage subsidies induce many to drop out of school: As a complement to the federal earned income tax credit (EITC), some states offer their own EITC, typically calculated as a percentage of […]

Is the earned income tax overrated?

Part II: Yes, Taxes Change Behavior

08 Oct 2025 Leave a comment

in applied price theory, labour economics, labour supply, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

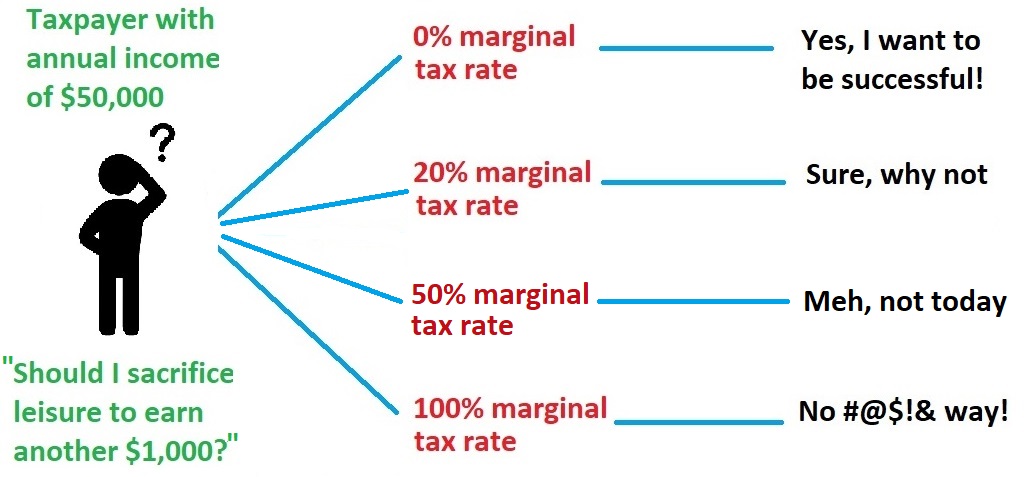

There are several visual ways of helping people understand how fiscal policy (and especially marginal tax rates) can change behavior. The philoso-raptor meme. The questioning worker. Supply-and-demand curves. The Wizard-of-Id parody. To augment these examples, I’ve started a series that is based on real-world examples. Part I of the series highlighted how the capital gains […]

Part II: Yes, Taxes Change Behavior

Getting rid of subidies creates wealth

06 Oct 2025 Leave a comment

in applied price theory, comparative institutional analysis, energy economics, industrial organisation, Public Choice, public economics Tags: electric cars, Internet, subsidies

REASON: Starting Today, Electric Vehicle Buyers No Longer Get a Federal Tax Credit. It’s bad news for upper-income motorists wanting a deal, but good news for taxpayers. In 2022, then-President Joe Biden signed the Inflation Reduction Act (IRA) into law…,[awarding] up to $7,500 for purchasing an electric vehicle. …Donald Trump [terminated the subsidy] on September…

Getting rid of subidies creates wealth

Part I: Yes, Taxes Change Behavior

26 Sep 2025 Leave a comment

in applied price theory, economic growth, entrepreneurship, fiscal policy, human capital, labour economics, labour supply, macroeconomics, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment, taxation and labour supply

From a big-picture economic perspective, I worry most about the damage of high tax burdens on innovation, entrepreneurship, and investment. Those are things that generate enormous benefits for society, yet also things that are very sensitive to bad tax policy (specifically high marginal tax rates and the tax code’s bias against saving and investment). Sadly, […]

Part I: Yes, Taxes Change Behavior

Newsflash! The super-rich are mobile, and higher taxes incentivise them to move away

25 Sep 2025 1 Comment

in applied price theory, human capital, income redistribution, labour economics, labour supply, occupational choice, Public Choice, public economics Tags: taxation and entrepreneurship, taxation and investment

The super-rich are super-mobile. So, if a country decides to increase taxes on the super-rich (for example, with a wealth tax), some (but not all) of the super-rich will simply move elsewhere. This should not be a surprise to anyone. And yet, simplistic proposals to tax the super-rich are a favourite policy for some political…

Newsflash! The super-rich are mobile, and higher taxes incentivise them to move away

Predistribution, Not Redistribution, in the Nordic Countries

15 Sep 2025 Leave a comment

in applied price theory, economic growth, economics of education, fiscal policy, income redistribution, labour economics, labour supply, macroeconomics, poverty and inequality, Public Choice, public economics, rentseeking Tags: Denmark, Finland, Norway, Sweden

Maybe it’s just because I live in Minnesota, a state where the differences between immigrants from Sweden, Norway, and Finland are still apparent in the names of towns and the surnames of people. But when I run into people who would prefer that the US distribution of income be more equal, they often point to…

Predistribution, Not Redistribution, in the Nordic Countries

Greens say taxing supermarkets more will lower food prices!

10 Sep 2025 Leave a comment

in applied price theory, economics of regulation, industrial organisation, Marxist economics, politics - New Zealand, Public Choice, public economics Tags: competition law

Radio NZ reports: But the Greens’ commerce and consumer affairs spokesperson Ricardo Menéndez March told RNZ that was only “one part of the puzzle” and the government needed to explore all its options – including breaking up the supermarket duopoly. “While we support having new players in the market, Nicola Willis is banking on big […]

Greens say taxing supermarkets more will lower food prices!

Recent Comments