US income taxes are highly progressive

19 Jun 2015 Leave a comment

in politics - USA, public economics Tags: earned income tax credit, family tax credits, progressive income taxes, tax incidence, top 1%, welfare state

The Nordics use optimal tax theory to fund their welfare states

12 Jun 2015 Leave a comment

in applied price theory, economic history, politics - USA, Public Choice, public economics Tags: Denmark, growth of government, Norway, optimal tax theory, Scandinavia, size of government, Sweden, welfare state

Efficient taxes gather more revenue and therefore are capable of funding a larger public sector with less political resistance from groups who are net taxpayers. The so-called neoliberal reforms of the 1980s and 1990s actually saved the welfare state by putting it on a revenue raising structure that provoked less political resistance.

A switch to more efficient taxes through tax reforms allows governments to raise the same amount or larger amount of revenue for the same level of political resistance from taxpayers. This is because less revenue and output is wasted by discouraging labour supply, investment, savings and investment in capital with high marginal rates of tax on narrower tax basis. Everyone gains from converging on more efficient modes redistribution.

The Nordic countries have been on to this application of optimal tax theory to expanding the size of government and the welfare state for a long time. The Nordics have high but flat taxes on labour income, low taxes on business income and a high, broad-based consumption tax be it called a VAT or GST as illustrated by a just published Tax Foundation report.

To begin with, the USA has a smaller government because it relies more income taxes than on consumption taxes.

Governments in Europe switched towards consumption taxes such as the VAT or GST because this allowed them to raise a large amount of revenue with broad-based taxes at low rates. A VAT or GST exempts exports and business to business transactions from taxes so that reduced taxpayer resistance.

Scandinavian income taxes raise much more revenue than in the USA because they are rather flat. That is, they tax most people at these high rates, not just high-income taxpayers. The top tax rate in the Scandinavian countries cuts in at about one and a half times average income or less rather than eight times average income as in the USA.

Flat high tax "How do Scandinavian countries pay for their govt spending?" bit.ly/1KZ7jOs @JimPethokoukis http://t.co/33oRg8Ozqh—

Old Whig (@aClassicLiberal) June 11, 2015

The marginal income tax rates including this top income tax rate cuts in a low level of income is also rather high in the Nordic countries relative to the USA’s top income tax rate with the exception of Norway.

Nonetheless the Nordic countries are alert to not killing the goose that laid the golden egg. Company taxes are relatively low in Scandinavian countries as compared to the USA so that businesses do not flee to other jurisdictions.

Top marginal tax rates on dividends and capital gains are not above-average in the Nordic states but their taxes on less mobile tax bases such as from labour and consumption are much higher.

A large welfare state such as those in the Nordic countries require a significant amount of revenue, so the tax base in these countries must be broad. This also means higher taxes on consumption through the VAT or GST and higher taxes on middle-income taxpayers.

Business taxes are a less reliable source of revenue because of capital flight and disincentives to invest. Thus, the Nordics do not place above-average tax burdens on capital income and focus taxation on labour and consumption.

via Sources of Government Revenue across the OECD, 2015 | Tax Foundation and How Scandinavian Countries Pay for Their Government Spending | Tax Foundation.

Which Anglo-Saxon country has the highest after-tax minimum wage?

05 Jun 2015 Leave a comment

in labour economics, minimum wage, public economics Tags: Australia, British economy, Canada, Ireland, progressive taxation, taxation and the labour supply, welfare state

Figure 1: Minimum wage after income tax and social security contributions, US$ PPP, Anglo-Saxon countries, 2013

John Key’s 2017 tax cuts will not be “modest”

04 Jun 2015 3 Comments

in economic growth, politics - New Zealand, Public Choice, public economics

Bill English’s 2015 New Zealand Budget foreshadows a $1.5 billion allowance in the 2017 budget for “modest tax cuts”. Any reasonable mock-up of these tax cuts, such as in table 1 using the numbers on the Treasury website for revenue losses for small tax changes show that Prime Minster Key is planning his own fistful of dollars in the lead up to the 2017 election.

Table 1: hypothetical 2017 National Party tax cuts, $1.5 billion

| Current tax rate | New tax rate | Revenue loss, static scoring |

Revenue loss, dynamic scoring |

| 33% | 31.5% | $323m | $274m |

| 30% | 27.5% | $388m | $329.4m |

| 17.5% | 16.5% | $505m | $429.3m |

| Trust tax 33% | Trust tax 31.5% | $135m | $129m |

| Company tax rate 28% | 27.5% | $113m | $90m |

| Total cost | $1.465b | $1251m |

No serious participant in public policy debate could suggest that tax cuts of the size in table 1 will not have incentive effects that will lead to growth in incomes and business profits. There will be offsetting tax revenue increases that make a more ambitious tax package possible in 2017.

The Treasury’s website on revenue losses forecasts that a 1% increase in wages growth will increase tax revenue by $300 million. A 1% increase in the growth rate of taxable business profits will increase tax revenues by $140 million again according to the Treasury. These are big differences.

Any sensible discussion of the 2017 tax cuts should be against a background of what is called dynamic scoring to use the American parlance.

When the NZ Treasury “scores” revenue losses from tax cuts on its website, its estimates of revenue changes assume no changes in behaviour. Dynamic scoring takes behavioural effects into account.

The Congressional Budget Office was recently required to use dynamic scoring when costing major tax policy proposals. New Zealand should follow this path.

Table 2 makes conservative assumptions about the behavioural effects of income tax cuts. I follow Mankiw, N. Gregory and Matthew Weinzierl “Dynamic Scoring: A Back-of-the-Envelope Guide,” Journal of Public Economics (September 2006): 1415-1433. They argue that, in the long run, about 17% of a cut in individual income taxes is recouped through higher economic growth. For a cut in company taxes, their figure is 50%. I assume 15% is recouped in this way for individuals, 20% for companies and 5% for trusts.

Table 2: hypothetical 2017 National Party tax cuts, $1.5 billion, dynamic scoring of revenue effects

| Current tax rate | New tax rate | Revenue loss static Scoring |

Revenue loss dynamic scoring |

| 33% | 31% | $430m | $366m |

| 30% | 27% | $465m | $395m |

| 17.5% | 16.5% | $505m | $429m |

| Trust tax 33% | Trust tax 31% | $180m | $171m |

| Company tax rate 28% | 27% | $225m | $180m |

| Total cost | $1.805b | $1.541b |

The $200-300 million in revenue increases from higher incomes and higher business profits incentivised by lower tax rates is not a trivial sum. It is enough on its own to cut one percentage point of the company tax rate. Spread around as in table 2, there are enough to knock another one-half of a percentage point of the top tax rate, the second top tax rate and the company tax rate. The $1.5 billion in tax cuts planned for 2017 will be neither modest in their size nor in their behavioural effects.

No budget should be published and no party in an election should assert that large changes in the tax system have no behavioural effects. Dynamic scoring makes a big difference to what scale of tax cuts are possible.

There are practical hurdles to dynamic scoring but static scoring has more important ones. The hurdles of dynamic scoring are:

- Economists do not know how to accurately measure the growth effects of most policies

- Dynamic scoring relies on less-than-accurate, theory-based macro models

- The macro models undergirding dynamic scoring have numerous controversial and unproven built-in assumptions

- The assumptions embedded in the macro models are not always carefully empirically based

- Macro models exclude theoretically and empirically supported evidence of supply-side effects of public investment

- Macro models exclude evidence-based effects of economic inequality

- Macro models exclude evidence-based effects of numerous policies

- Macro models provide different estimates of growth impacts of policy depending on guesses of how the policy may be finance

Against that is dynamic scoring removes the bias against pro-growth policies in current budgetary scoring:

[A] theoretical advantage of accurate dynamic scoring is that it is not biased against pro-growth policies compared to the current conventional scoring method. By ignoring macroeconomic effects, the conventional method overstates the true budgetary cost of pro-growth policies, such as infrastructure investments, and understates the cost of anti-growth policies.

To close on some New Zealand politics, Prime Minister Key, who is known as the smiling assassin, overtook the Labour Party and the Greens on their left In the 2015 Budget by increasing welfare benefits for the first time since 1972 in real terms, and by a large amount ($25 a week), and also increasing family tax credits.

Prime Minister Key well then pivot to the right in 2017 with a fistful of dollars to firmly camp himself over both the centre-left in the centre-right to be re-elected for a fourth term against an increasingly hapless and out-manoeuvred opposition.

Average tax rates versus tax revenue as a percentage of the GDP

31 May 2015 Leave a comment

in economic history, politics - USA, public economics, taxation Tags: average tax rates, growth of government, size of government

Tax revenue as a percentage of GDP for the European offshoots (USA, Canada, Australia and New Zealand), 1965–2013

30 May 2015 2 Comments

in economic history, politics - Australia, politics - New Zealand, politics - USA, public economics Tags: Australia, Canada, growth of government

The tax take is noticeably higher in Canada and New Zealand and has been for a long time.

Figure 1: US, Canadian, Australian and New Zealand tax revenues as a percentage of GDP, 1965–2013

Source: OECD StatExtract.

Does Inequality Reduce Economic Growth: A Sceptical View

30 May 2015 Leave a comment

in applied price theory, applied welfare economics, comparative institutional analysis, development economics, economic history, entrepreneurship, growth disasters, growth miracles, income redistribution, politics - Australia, politics - New Zealand, politics - USA, Public Choice, public economics, rentseeking Tags: entrepreneurial alertness, Leftover Left, taxes and the labour supply, The inequality and growth, Thomas Piketty, top 1%, Twitter left

Tim Taylor, the editor of the Journal of Economic Perspectives, has written a superb blog post on why we should be sceptical about a strong relationship between inequality and economic growth. Taylor was writing in response to the OECD’s recent report "In It Together: Why Less Inequality Benefits All,".

Taylor’s basic point is economists have enough trouble working out what causes economic growth so trawling within that subset of causes to quantify the effects of rising or falling inequality inequality seems to be torturing the data to confess. The empirical literature is simply inconclusive as Taylor says:

A variety of studies have undertaken to prove a connection from inequality to slower growth, but a full reading of the available evidence is that the evidence on this connection is inconclusive.

Most discussions of the link between inequality and growth are notoriously poor of theories connecting two. There are three credible theories in all listed in the OECD’s report:

The report first points out (pp. 60-61 that as a matter of theory, one can think up arguments why greater inequality might be associated with less growth, or might be associated with more growth. For example, inequality could result less growth if:

1) People become upset about rising inequality and react by demanding regulations and redistributions that slow down the ability of an economy to produce growth;

2) A high degree of persistent inequality will limit the ability and incentives of those in the lower part of the income distribution to obtain more education and job experience; or

3) It may be that development and widespread adoption of new technologies requires demand from a broad middle class, and greater inequality could limit the extent of the middle class.

About the best theoretical link between inequality and economic growth is what Taylor calls the "frustrated people killing the goose that lays the golden eggs." Excessive inequality within a society results in predatory government reactions at the behest of left-wing or right-wing populists.

Taylor refers to killing the goose that laid the golden egg as dysfunctional societal and government responses to inequality. He is right but that is not how responses to inequality based on higher taxes and more regulation are sold. Thomas Piketty is quite open about he wants a top tax rate of 83% and a global wealth tax to put an end to high incomes:

When a government taxes a certain level of income or inheritance at a rate of 70 or 80 percent, the primary goal is obviously not to raise additional revenue (because these very high brackets never yield much).

It is rather to put an end to such incomes and large estates, which lawmakers have for one reason or another come to regard as socially unacceptable and economically unproductive…

The left-wing parties don’t say let’s put up taxes and redistribute so that is not something worse and more destructive down the road. Their argument is redistribution will increase growth or at least not harm it. That assumes the Left is addressing this issue of not killing the goose that lays the golden egg at all.

Once you discuss the relationship between inequality and growth in any sensible way you must remember your John Rawls. Incentives encourage people to work, save and invest and channels them into the occupations where they make the most of their talents. Taylor explains:

In the other side, inequality could in theory be associated with faster economic growth if: 1) Higher inequality provides greater incentives for people to get educated, work harder, and take risks, which could lead to innovations that boost growth; 2) Those with high incomes tend to save more, and so an unequal distribution of income will tend to have more high savers, which in turn spurs capital accumulation in the economy.

Taylor also points out that the OECD’s report is seriously incomplete by any standards because it fails to mention that inequality initially increases in any poor country undergoing economic development:

The report doesn’t mention a third hypothesis that seems relevant in a number of developing economies, which is that fast growth may first emerge in certain regions or industries, leading to greater inequality for a time, before the gains from that growth diffuse more widely across the economy.

At a point in its report, the OECD owns up to the inconclusive connection between economic growth and rising inequality as Taylor notes:

The large empirical literature attempting to summarize the direction in which inequality affects growth is summarised in the literature review in Cingano (2014, Annex II).

That survey highlights that there is no consensus on the sign and strength of the relationship; furthermore, few works seek to identify which of the possible theoretical effects is at work. This is partly tradeable to the multiple empirical challenges facing this literature.

The OECD’s report responds to this inclusiveness by setting out an inventory of tools with which you can torture the data to confess to what you want as Taylor notes:

There’s an old saying that "absence of evidence is not evidence of absence," in other words, the fact that the existing evidence doesn’t firmly show a connection from greater inequality to slower growth is not proof that such a connection doesn’t exist.

But anyone who has looked at economic studies on the determinants of economic growth knows that the problem of finding out what influences growth is very difficult, and the solutions aren’t always obvious.

The chosen theory of the OECD about the connection between inequality and economic growth is inequality leads to less investment in human capital at the bottom part of the income distribution.

[Inequality] tends to drag down GDP growth, due to the rising distance of the lower 40% from the rest of society. Lower income people have been prevented from realising their human capital potential, which is bad for the economy as a whole

I found this choice of explanation curious. So did Taylor as the problem already seems to have been solved:

There are a few common patterns in economic growth. All high-income countries have near-universal K-12 public education to build up human capital, along with encouragement of higher education. All high-income countries have economies where most jobs are interrelated with private and public capital investment, thus leading to higher productivity and wages.

All high-income economies are relatively open to foreign trade. In addition, high-growth economies are societies that are willing to allow and even encourage a reasonable amount of disruption to existing patterns of jobs, consumption, and ownership. After all, economic growth means change.

In New Zealand, interest free student loans are available to invest in higher education as well as living allowances for those with parents on a low income. There are countries in Europe with low levels of investment in higher education but that’s because of high income taxes not because of inequality.

The OECD’s report is fundamentally flawed which is disappointing because most research from the OECD is to a good standard.

via CONVERSABLE ECONOMIST: Does Inequality Reduce Economic Growth: A Skeptical View.

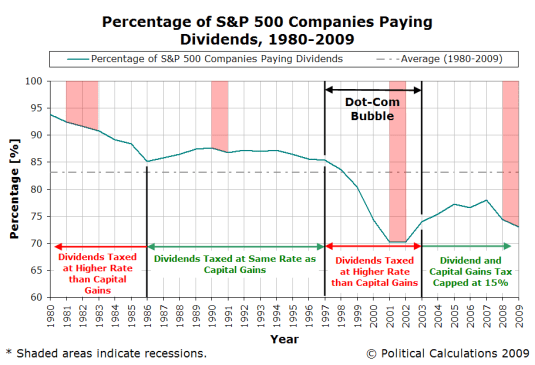

Did changes in capital gains and dividend tax rates caused the dot.com bubble to begin and end?

30 May 2015 Leave a comment

in applied price theory, economic history, entrepreneurship, financial economics, public economics Tags: capital gains tax, dot.com bubble, entrepreneurial alertness, tax arbitrage

…the Taxpayer Relief Act of 1997 left dividend tax rates unchanged – they continued to be taxed at the same rates as regular income in the United States, which provided a powerful incentive for investors to treat the two kinds of stocks very differently, favouring the low-to-no dividend paying stocks over those that paid out more significant dividends.

At least, until May 2003, when the compromises that led to, and ultimately the signing of the Jobs and Growth Tax Relief Reconciliation Act of 2003 would set both the tax rates for capital gains and for dividends to once again be equal to one another, as they had been in the years from 1986 through 1997…

the founding and rapid growth of new computer and Internet technology-oriented companies in the early 1990s, which grew rapidly to become large companies and which as growth companies, did not pay significant dividends to shareholders, provided the critical mass needed for the 1997 capital gains tax cut to launch the Dot Com Bubble.

via Political Calculations: What Caused the Dot Com Bubble to Begin and What Caused It to End?.

Scandinavian tax revenues as a % of GDP, 1965–2013

29 May 2015 Leave a comment

in economic history, public economics, Sam Peltzman Tags: Denmark, Finland, growth of government, Norway, Sweden

Peltzman was right! Scandinavian growth in the size of government stopped in the early 1980s.

Figure 1: Danish, Finnish, Norwegian and Swedish tax revenues as a percentage of GDP, 1965–2013

Source: OECD StatExtract.

French, German, British and US tax revenues as % of GDP, 1965 – 2013

28 May 2015 Leave a comment

in economic history, politics - USA, public economics, taxation Tags: British economy, France, Germany, growth of government

Figure 1: Tax revenue as percentage of French, German, British and US GDP, 1965–2013

Source: OECD StatExtract.

New Zealand’s Experience with Territorial Taxation | Tax Foundation

18 May 2015 Leave a comment

in politics - New Zealand, politics - USA, public economics Tags: company tax, endogenous growth theory, foreign direct investment, lost decades

New Zealand is one of only two developed countries, the other being Finland, that switched from a territorial tax system to a worldwide system.Both eventually returned to a territorial tax system for competitiveness reasons. New Zealand went one step further in their experiment with worldwide taxation by ending deferral.

This resulted in a twenty year stagnation in foreign investment at a time when foreign investment was growing dramatically in the rest of the developed world.

This coincided with an economic decline in New Zealand relative to Australia and the rest of the developed world. Because foreign investment is key to accessing the world’s consumers, it is not surprising that less foreign investment translated to less economic prosperity at home.

The New Zealand experience shows that ending or limiting deferral in the United States, as President Obama and others have proposed, would likely have severe economic downsides. Instead, as New Zealand eventually did in 2009, the U.S. should implement a territorial system that exempts foreign earnings.

via New Zealand’s Experience with Territorial Taxation | Tax Foundation.

Housing affordability trends in New Zealand and the case for a capital gains tax

14 May 2015 Leave a comment

in applied price theory, economics of regulation, Public Choice, public economics, rentseeking, urban economics Tags: Auckland, capital gains tax, housing affordability, RMA

If the affordability crisis in New Zealand is demand side driven requiring capital gains tax to temper that demand, why is the affordability crisis so marked in one city? Does that make a case for a capital gains tax only on Auckland or suggest the capital gains tax is trying to solve the wrong problem.

via demographia.com

Does tax reform lead to lower taxes?

14 May 2015 Leave a comment

in politics - Australia, politics - New Zealand, politics - USA, public economics, taxation Tags: efficient taxes, tax reform

Annual hours worked per working age American, German and French, 1950–2013

12 May 2015 Leave a comment

in applied price theory, economic growth, economic history, great depression, labour economics, labour supply, macroeconomics, politics - USA, Public Choice, public economics, taxation Tags: Edward Prescott, Euroclerosis, France, Germany, labour supply, Robert Lucas, taxation and labour supply

Figure 1 shows that Americans work the same hours per year pretty much the entire post-war period. By contrast, there is been a long decline in hours worked in Germany and France. The large drop in 1992 was German unification.

Figure 1: annual hours worked per working age American, German and French, 1950 – 2013

Source: OECD StatExtract and The Conference Board Total Economy Database™,January 2014, http://www.conference-board.org/data/economydatabase/

The long decline seemed to tally with the disproportionately sharp rise in the average tax rate on labour income, including social security contributions in France and Germany. When tax rates on labour income, including social security contributions stabilised in about 1980, hours worked stabilised in all countries.

Figure 2: average tax rate on labour income,USA, Germany and France, 1950 – 2013

Source: Source: Cara McDaniel.

Some pander to the great vacation theory of European labour supply. This is the hypothesis of a large increase in the preference for leisure in the European Union member states. That is, mass voluntary unemployment and mass voluntary reductions and labour supply by choice by Europeans. They just decided to work less.

This is not the first outing for the great vacation theory of labour supply. In the late 1970s, Modigliani dismissed the new classical explanation of Lucas and Rapping (1969) of the U.S. great depression in which the 1930s unemployment was voluntary unemployment – the great depression was just a great vacation – with the following remarks:

Sargent (1976) has attempted to remedy this fatal flaw by hypothesizing that the persistent and large fluctuations in unemployment reflect merely corresponding swings in the natural rate itself.

In other words, what happened to the U.S. in the 1930’s was a severe attack of contagious laziness!

I can only say that, despite Sargent’s ingenuity, neither I nor, I expect most others at least of the non-Monetarist persuasion, are quite ready yet. to turn over the field of economic fluctuations to the social psychologist!

As Prescott has pointed out, the USA in the Great Depression and France since the 1970s both had 30% drops in hours worked per adult. That is why Prescott refers to France’s economy as depressed. The reason for the depressed state of the French (and German) economies is taxes, according to Prescott:

Virtually all of the large differences between U.S. labour supply and those of Germany and France are due to differences in tax systems.

Europeans face higher tax rates than Americans, and European tax rates have risen significantly over the past several decades.

Countries with high tax rates devote less time to market work, but more time to home activities, such as cooking and cleaning. The European services sector is much smaller than in the USA.

Time use studies find that lower hours of market work in Europe is entirely offset by higher hours of home production, implying that Europeans do not enjoy more leisure than Americans despite the widespread impression that they do. Europeans did not work less. They worked more on activities that were not taxed.

Recent Comments