Irish War of Independence – Black and Tans vs. IRA Guerrillas I THE GREAT WAR 1920

17 Mar 2020 Leave a comment

in defence economics, development economics, economic history, laws of war, war and peace Tags: Ireland, World War I

The Invisible 310-Mile Barrier to a #Brexit Deal | @WSJ

17 Oct 2019 Leave a comment

in defence economics, economic history, economics of crime, industrial organisation, international economic law, international economics, International law, law and economics, Public Choice Tags: Brexit, Ireland

Why didn’t Rome Conquer Ireland? (Short Animated Documentary)

06 Oct 2019 Leave a comment

in defence economics, economic history Tags: Ireland, Roman empire

The Easter Rising – Ireland in World War 1 I THE GREAT WAR Special

20 Apr 2019 Leave a comment

in defence economics, economics of crime, law and economics, war and peace Tags: Ireland, World War I

The Irish Potato Famine (1845–1852)

03 Jan 2019 Leave a comment

in development economics, economic history, International law, Public Choice, public economics Tags: British history, Ireland

Irish regional accents – Niall Tóibín

31 May 2018 Leave a comment

in economics of media and culture Tags: economics of languages, Ireland

College and post-graduate wage premium in the English speaking countries, France, S. Korea, Finland, Denmark, Norway and Sweden

31 Jul 2016 Leave a comment

in economics of education, human capital, labour economics, occupational choice Tags: Australia, British economy, Canada, College premium, Denmark, education premium, Finland, France, graduate premium, Ireland, Korea, Norway, post-graduate premium, Sweden

Source: Education at a Glance 2015, section 6.

Dara Ó Briain – A Catholic & Protestant Mixed Marriage

20 Jun 2016 Leave a comment

in economics, economics of love and marriage, economics of religion, property rights Tags: Ireland

HT: Donal McChaffery

General government net financial liabilities as % Portuguese, Italian, Greek, Spanish and Irish GDPs

03 Jun 2016 Leave a comment

in budget deficits, business cycles, economic growth, economic history, Euro crisis, financial economics, fiscal policy, global financial crisis (GFC), macroeconomics Tags: Greece, Ireland, Italy, Portugal, public debt management, sovereign debt crises, sovereign defaults, Spain

I had borrowed a lot of money from scratch after 2007. Greece borrowed a lot of money of its own accord from 2010. Italy always owed a lot of money. Spanish do not know all that much money considering their dire financial circumstances.

Source: OECD Economic Outlook June 2016 Data extracted on 01 Jun 2016 12:57 UTC (GMT) from OECD.Stat

@TheAusInstitute has not heard of Ireland’s 12.5% company tax and European tax harmonisation

19 May 2016 Leave a comment

in politics - Australia, politics - New Zealand, politics - USA, public economics Tags: company tax rate, Ireland, race to the bottom, tax competition, tax harmonisation, taxation and investment

The Australia Institute has been running the line that cutting the Australian company tax rate just means more tax revenue for offshore tax departments. They will tax the larger after-tax Australian dividends in the home country of the foreign investor if Australia were to cut its company tax rate.

Source: David Richardson, Company tax cuts: An Australian gift to the US Internal Revenue Service How a cut to the Australian company tax rate would result in a windfall for the United States Treasury. Australia Institute (May 2015).

The Australia Institute obviously has not picked up on the relentless bullying that Ireland was subject to by the rest of the European Union over its 12.5% company tax.

The Irish company tax rate of 12.5% was initially on export profits. To finesse European Union member state complaints about that 12.5% company tax rate on discrimination grounds, the Irish government extended that low rate to all companies in 1995.

I am yet to see a minister of finance welcoming a company tax cut in a competing jurisdiction, rubbing his hands in anticipation of greater tax revenues on the foreign profits of companies headquartered in his country.

If there is no race to the bottom in company tax rates, you must wonder why there is substantial efforts within the European Union on tax harmonisation regarding company tax?

France and Germany are pushing plans to introduce a minimum corporation tax rate across the continent, it was reported today, in a move that could result in higher taxes on British companies.

European officials will debate plans to set a EU-wide floor on corporation tax in order to crack down on tax havens such as Ireland and Luxembourg, it emerged.

If there is an ounce of sense in what the Australia Institute said about foreign taxmen benefiting from low company taxes in Australia, high corporate tax rate countries such as Germany, France and the USA should welcome low company tax rates in destination countries for foreign investment originating in those countries but they do not. Rather than seek tax harmonisation, high tax country should welcome low company taxes in competing investment destinations but they do not.

About $2 trillion in profits is held offshore by American businesses because they do not pay company tax in the USA until they actually repatriate the profits to the USA. This is common. You wonder what the purpose of tax havens is if a company tax rate cut in Australia is so easily captured by the IRS?

Studies of the company tax in the USA suggest that a cut in that company tax would lead to large inflows of foreign investment into the USA boosting wages significantly.

Actual and synthetic real per capita GDP and real per worker GDP in the 1973 EU enlargement

27 Apr 2016 Leave a comment

in economic history, international economics Tags: British economy, Common market, customs unions, Denmark, EU membership, European Union, Ireland

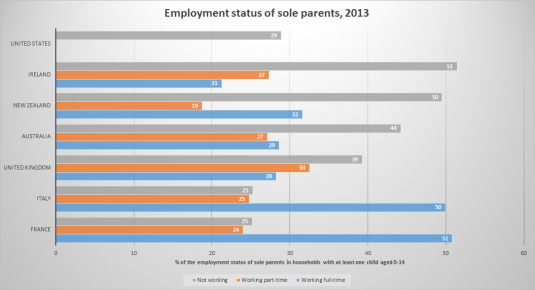

Employment status of sole parents in UK, USA, France, Italy, Australia, Ireland and New Zealand

13 Nov 2015 Leave a comment

in economics of love and marriage, labour supply, politics - Australia, politics - New Zealand, politics - USA Tags: Australia, British economy, France, Ireland, Italy, maternal labour supply, single parents, sole parents, welfare state

Despite supposedly having stingy welfare states, both New Zealand and Australia have a lot of sole parents who do not work at all. There is no separate breakdown of full-time and part-time work status in the USA. About 72% of sole parents in the USA either work full-time or part-time.

Source: OECD Family Database.

Tertiary education premium by gender in the English-speaking countries, 2012

19 Oct 2015 1 Comment

in discrimination, economics of education, gender, human capital, labour economics, occupational choice, politics - Australia, politics - New Zealand, politics - USA Tags: Australia, British economy, Canada, College premium, education premium, gender wage gap, Ireland, New Zealand, reversing gender gap

There are large differences in the education premium between English speaking countries and also by gender. The tertiary premium in New Zealand is pretty poor compared to the USA, UK or Ireland and is still mediocre when compared to Australia and Canada.

Source: Education at a Glance 2014.

British and Irish real housing prices since 1975

18 Oct 2015 Leave a comment

in applied price theory, applied welfare economics, economic history, economics of regulation, urban economics Tags: British politics, housing prices, Ireland, land supply, land use planning, zoning

Source and notes: International House Price Database – Dallas Fed June 2015; nominal housing prices for each country is deflated by the personal consumption deflator for that country.

Recent Comments