John Cochrane is the latest to join the list of economists who pointed out that Greece should have defaulted several years ago rather than put up taxes. Tax rises just made everything worse and put off the day when Greece had to reform through deregulation and privatisation.

Source: Renowned U.S. Economist Says High Taxes Squash Greece’s Prospects for Recovery | GreekReporter.com.

As early as 2011 , Jeffrey Miron was arguing the best way forward for Greece was to default and leave the Euro:

If Greece defaults, the country gets immediate relief from the crushing interest payments on its debt, leaving it with a relatively modest primary deficit which excludes the big interest payments Greece is faced with now.

In such a scenario, the pressure for austerity would therefore diminish. This would allow Greece to choose policies that encourage growth, rather than ones that shrink the deficit but retard growth by imposing higher taxes.

By abandoning the euro and adopting a properly valued currency, Greece can restore its international competitiveness. This means greater employment demand from both domestic and foreign sources.

The potential negative of default is that Greece will likely lose access, for a while, to international credit markets (although it will be a much safer investment after default than it is now).

But being cut off from foreign lending for a few years is not a disaster; if anything, it might encourage cuts in the wasteful components of government spending.

A bigger risk of default is that ending the crisis might reduce pressure for Greece to address the economy’s fundamental problems: crony capitalism, a Byzantine tax code, excessive regulation, and a bloated government sector.

If Greece fails to reform, it will suffer slow growth and a new crisis soon, regardless of what it does now.

Arellano, Conesa, and Kehoe explained in Chronic Sovereign Debt Crises in the Eurozone, 2010–2012 that the post-GFC recession in many Eurozone countries created an incentive to gamble for redemption. This gamble for redemption is betting that the post-2008 recession will soon end:

- If Greece sold more bonds to smooth government spending in the interim, and if the Greek and EU economies recover, the stronger revenue growth will pay off the enlarged Greek government debt.

- Under some circumstances, this policy is the best that a government can do for its country, but it carries a risk!

- If the recession goes on for too long (and it did in southern Eurozone), a government will either have to stop increasing its debt or default on its bonds.

The global bond markets will anticipate this prospect of default as a country’s government debt accumulates and will seek higher and higher interest for new bonds, and importantly, to roll over existing Greek Government bonds.

EU policies that result in lower interest rates and lower the cost of a sovereign default provide incentives for a government to gamble for redemption. The interventions taken to date by the EU and the IMF – lowering the cost of borrowing and reducing default penalties, the bailouts and the 50% write-off of the existing Greek government debts – encourage southern Eurozone governments to gamble for redemption.

Through history, sovereign defaults come in clusters. Is Greece the start of one? on.wsj.com/1V3XkxR via @WSJ http://t.co/Oy9aMPoHrt—

Greg Ip (@greg_ip) July 15, 2015

Greece and a few others are gambling for redemption by betting that the recession will end soon, selling more bonds to smooth government spending in the interim, and reducing the enlarged debt if their economies recover. The Greeks initially did a fine job in squeezing huge subsidies and debt write-offs!

If the recession continues for too long, the government will have to stop increasing debt or default on its bonds. Greece has been in default in more than 50% of the time since it became independent in 1822.

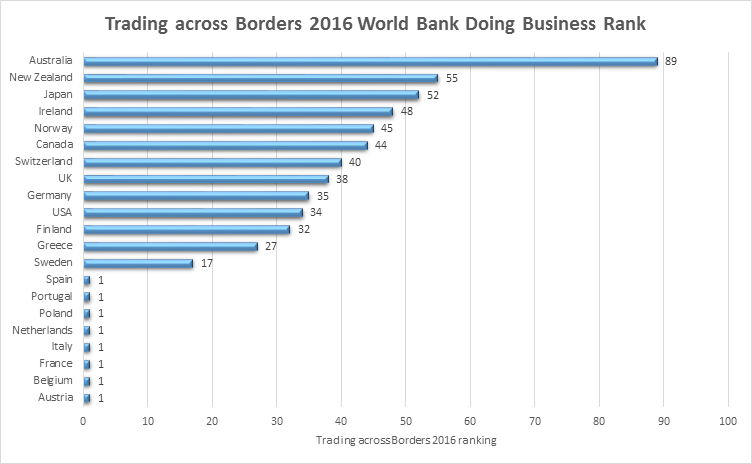

Greece’s problem is that it is 119th in the 2014 index of economic freedom, just ahead of India. The World Bank ranks Greece 161st in the world for ease of registering property and 91st for enforcing contracts; it takes an average of 1,300 days to enforce a contract through the Greek courts. This low base says something about how Greek politics works and will work for some time to come.

Cristina Arellano in a recent paper pointed out that if default is inevitable, raising taxes just makes everything worse:

Fiscal defaults occur because of the government’s inability to raise tax revenues. Aggregate defaults occur even if the government could raise tax revenues; debt is simply too high to be sustainable.

In a quantitative exercise calibrated to Greece, we find that our model can predict the recent default, but that increasing taxes would not have prevented it. In fact, increasing taxes would have made the recession deeper because of the distortionary effects of taxation.

Recent Comments