The Washington Centre for Equitable Growth recently tweeted that inequality harms growth in the USA as compared to Sweden, France, Germany and the UK. It was relying on some dodgy OECD research.

The Washington Centre for Equitable Growth did not check their inequality ratios they tweeted against trends in economic growth and economic policy since 1970, which I have reproduced in figure 1. Germany is not included in figure 1 because German data on growth is thrown askew by German unification.

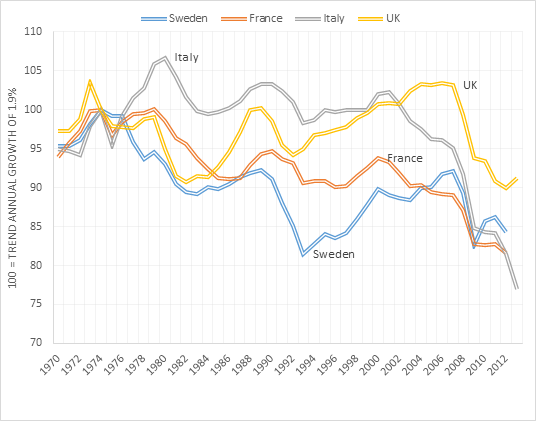

Figure 1: Real GDP per British, French and Swede aged 15-64, 2014 US$ (converted to 2014 price level with updated 2011 PPPs), 1.9 per cent detrended, 1970-2013

Source: Computed from OECD Stat Extract and The Conference Board. 2015. The Conference Board Total Economy Database™, May 2015, http://www.conference-board.org/data/economydatabase/

Figure 1 shows that France has been in a long-term decline since the late 1970s despite the blessings of a more equal society than the USA as championed by the Washington Centre for Equitable Growth. In figure 1, a flat line is growth in real GDP per working age person, PPP, at the same rate as the USA for the 20th century, which was 1.9% per year. A falling line in figure 1 indicates growth of less than 1.9% while a rising line indicates growth in real GDP per working age person, PPP, in excess of 1.9%. In figure 1, France hardly ever grew at the trend rate of growth for the USA of 1.9% per year and was frequently well below that rate.

Sweden tells a slightly different story in figure 1 because of regime change in the early 1990s when Sweden adopted more liberal economic policies where taxes and government spending were reduced:

The rapid growth of the state in the late 1960s and 1970s led to a large decline in Sweden’s relative economic performance. In 1975, Sweden was the 4th richest industrialised country in terms of GDP per head. By 1993, it had fallen to 14th.

That regime change reversed a long economic decline since 1970 under the egalitarian policies of the Swedish Social Democratic Party. Under the Swedish Social Democratic Party, Sweden was almost always growing at less than the trend rate of growth of the USA, which was 1.9%. That position reversed only when there was a turn away from big government and high taxes.

Figure 1 tells a similar story for the British economy: a long economic decline in the 1970s when Britain was the sick man of Europe. Under Thatchernomics, Europe had a long economic boom for 20 years or more – see figure 1.

In the 1970s, under the high taxes of the Heath, Callaghan and Wilson administrations, as figure 1 shows, Britain was the sick man of Europe. With the election of the Thatcher Government, Britain soon grew at better than the US trend growth rate for nearly 20 years through few exceptions.

Recent Comments