14 Aug 2015

by Jim Rose

in applied price theory, income redistribution, labour economics, politics - New Zealand, poverty and inequality, Public Choice, public economics

Tags: child poverty, Director's Law, family poverty, family tax credits, welfare state

One group with negative net tax liability is low- to middle-income households with dependent children. For example, single-earner families with two children can earn up to around $60,000 pa before they pay any net tax.

Around half of all households with children receive more in welfare benefits and tax credits than they pay in income tax.

Bryan Perry (2015, p. 41)

![clip_image002[6] clip_image002[6]](https://utopiayouarestandinginit.com/wp-content/uploads/2015/08/clip_image0026_thumb.jpg?w=268&h=177)

14 Aug 2015

by Jim Rose

in currency unions, Euro crisis, job search and matching, labour economics, labour supply, macroeconomics, unemployment

Tags: British economy, equilibrium unemployment rate, France, Germany, long-term unemployment, natural unemployment rate, social insurance, unemployment duration, unemployment insurance, welfare state

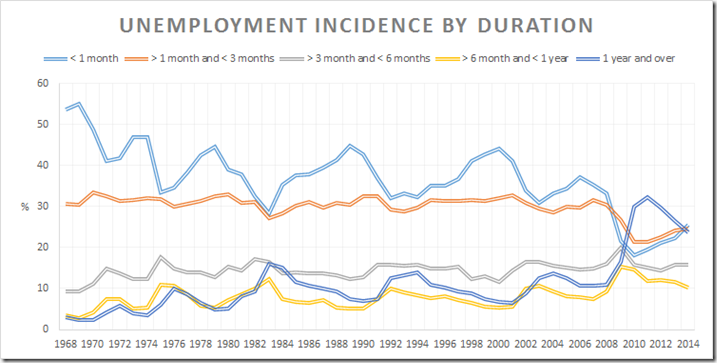

As the British labour market and long-term unemployment was starting to get something like that in the USA, the USA started to have unemployment it was more like the European labour markets in terms of the number of long-term unemployed. Nothing much happened in Germany and France.

Source: OECD StatExtract.

11 Aug 2015

by Jim Rose

in economic history, Euro crisis, fiscal policy, job search and matching, labour economics, labour supply, macroeconomics, unemployment, welfare reform

Tags: equilibrium unemployment rate, Eurosclerosis, German unification, Germany, natural unemployment rate, poverty traps, unemployment duration, unemployment insurance, welfare state

German long term unemployment has been pretty stable albeit with an up-and-down after German unification. There is also a fall in long-term unemployment after some labour market reforms around 2005.

Source: OECD StatExtract.

10 Aug 2015

by Jim Rose

in applied price theory, applied welfare economics, comparative institutional analysis, currency unions, economic growth, economic history, economics of regulation, entrepreneurship, Euro crisis, fiscal policy, global financial crisis (GFC), income redistribution, labour economics, labour supply, macroeconomics, Marxist economics, poverty and inequality, Public Choice, public economics, rentseeking

Tags: British disease, entrepreneurial alertness, Eurosclerosis, France, German unification, Germany, growth of government, sick man of Europe, social insurance, Sweden, taxation and entrepreneurship, taxation and investment, taxation and labour supply, welfare state

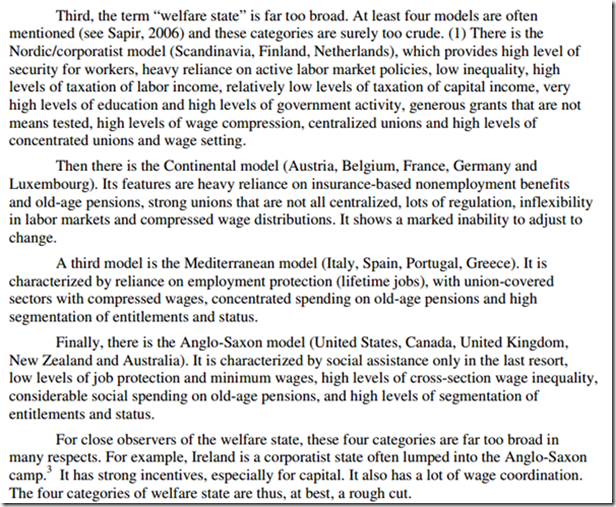

The Washington Centre for Equitable Growth recently tweeted that inequality harms growth in the USA as compared to Sweden, France, Germany and the UK. It was relying on some dodgy OECD research.

The Washington Centre for Equitable Growth did not check their inequality ratios they tweeted against trends in economic growth and economic policy since 1970, which I have reproduced in figure 1. Germany is not included in figure 1 because German data on growth is thrown askew by German unification.

Figure 1: Real GDP per British, French and Swede aged 15-64, 2014 US$ (converted to 2014 price level with updated 2011 PPPs), 1.9 per cent detrended, 1970-2013

Source: Computed from OECD Stat Extract and The Conference Board. 2015. The Conference Board Total Economy Database™, May 2015, http://www.conference-board.org/data/economydatabase/

Figure 1 shows that France has been in a long-term decline since the late 1970s despite the blessings of a more equal society than the USA as championed by the Washington Centre for Equitable Growth. In figure 1, a flat line is growth in real GDP per working age person, PPP, at the same rate as the USA for the 20th century, which was 1.9% per year. A falling line in figure 1 indicates growth of less than 1.9% while a rising line indicates growth in real GDP per working age person, PPP, in excess of 1.9%. In figure 1, France hardly ever grew at the trend rate of growth for the USA of 1.9% per year and was frequently well below that rate.

Sweden tells a slightly different story in figure 1 because of regime change in the early 1990s when Sweden adopted more liberal economic policies where taxes and government spending were reduced:

The rapid growth of the state in the late 1960s and 1970s led to a large decline in Sweden’s relative economic performance. In 1975, Sweden was the 4th richest industrialised country in terms of GDP per head. By 1993, it had fallen to 14th.

That regime change reversed a long economic decline since 1970 under the egalitarian policies of the Swedish Social Democratic Party. Under the Swedish Social Democratic Party, Sweden was almost always growing at less than the trend rate of growth of the USA, which was 1.9%. That position reversed only when there was a turn away from big government and high taxes.

Figure 1 tells a similar story for the British economy: a long economic decline in the 1970s when Britain was the sick man of Europe. Under Thatchernomics, Europe had a long economic boom for 20 years or more – see figure 1.

In the 1970s, under the high taxes of the Heath, Callaghan and Wilson administrations, as figure 1 shows, Britain was the sick man of Europe. With the election of the Thatcher Government, Britain soon grew at better than the US trend growth rate for nearly 20 years through few exceptions.

10 Aug 2015

by Jim Rose

in applied welfare economics, comparative institutional analysis, economic growth, economic history, economics of regulation, industrial organisation, labour economics, labour supply, macroeconomics, survivor principle

Tags: Eurosclerosis, Sweden, taxation and entrepreneurship, taxation and investment, taxation and labour supply, welfare state

08 Aug 2015

by Jim Rose

in budget deficits, great recession, job search and matching, labour economics, labour supply, macroeconomics, politics - USA, unemployment, welfare reform

Tags: natural unemployment rate, taxation and labour supply, unemployment duration, unemployment insurance, unemployment rates, welfare state

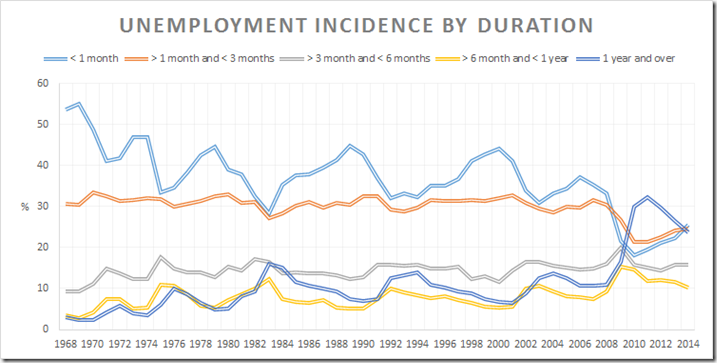

The Great Recession was the first recession in the USA in a good 40 to 50 years where the composition of employment changed by much. Even the big recession at the beginning of the 1980s did not do much to the composition of unemployment by duration in the USA.

Source: OECD StatExtract.

Those unemployed for more than a year moved from barely double digits even in a bad recession prior to 2008 to coming on one-third of all unemployed. Likewise, those unemployed for less than a month halved from 40% to 20%. Something changed in the US labour market with the Great Recession and the long extensions of unemployment insurance from 26 weeks to 52 weeks and then 99 weeks.

07 Aug 2015

by Jim Rose

in applied welfare economics, fiscal policy, labour economics, politics - Australia, politics - New Zealand, politics - USA, poverty and inequality, welfare reform

Tags: Denmark, Finland, life expectancies, Norway, Sweden, welfare state

31 Jul 2015

by Jim Rose

in labour economics, labour supply, poverty and inequality, unemployment, welfare reform

Tags: James Bartholomew, poverty traps, social insurance, Social Security, taxation and the labour supply, welfare reform, welfare state

25 Jul 2015

by Jim Rose

in economic history, gender, labour economics, labour supply, politics - USA

Tags: ageing society, British economy, demographic crisis, economics of retirement, effective retirement ages, female labour force participation, female labour supply, France, Germany, male labour force participation, male labour supply, old age pensions, older workers, retirement ages, social insurance, Social Security, welfare state

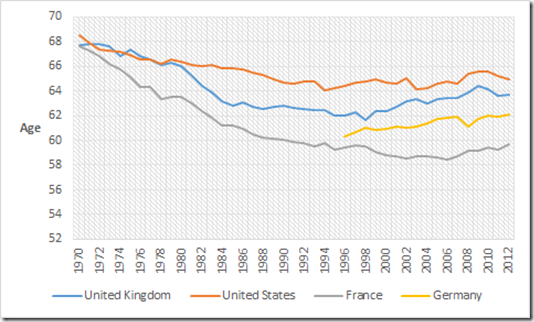

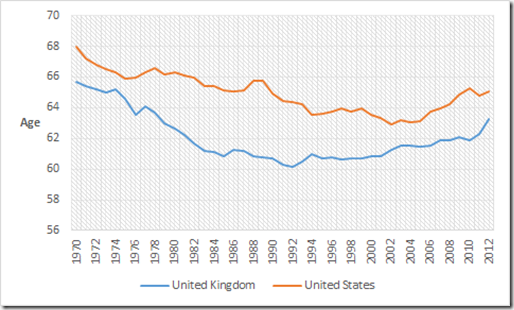

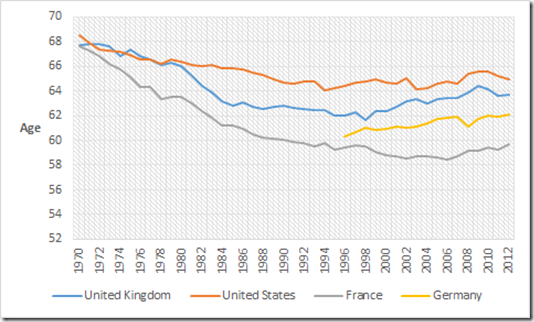

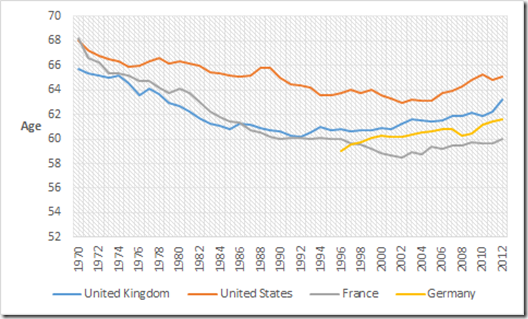

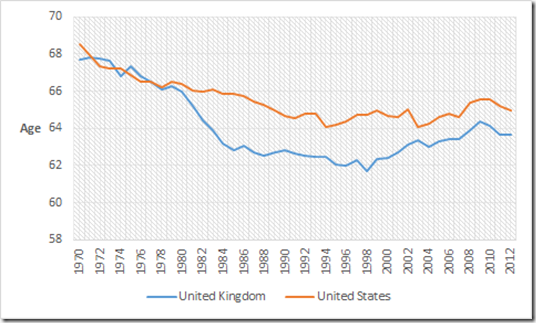

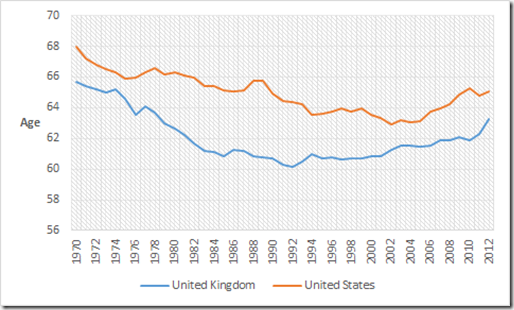

Figure 1 shows a divergence from a common starting point in 1974 effective retirement ages. The French in particular were the first to put their feet up and start retiring by the age of 60 by the early 1990. There was also a sharp increase in the average effective retirement age for men in the UK over a short decade. After that, British retirement ages for men started to climb again in the late 1990s. Figure 1 also shows that the gentle taper in the effective retirement age for American men stopped at the 1980s and started to climb again in the 2000s. The German data is too short to be of much use because of German unification. France only recently stopped seeing its effective retirement age fall and it is slightly increased recently – see figure 1

Figure 1: average effective retirement age for men, USA, UK, France and Germany, 1970 – 2012, (five-year average)

Source: OECD Pensions at a Glance.

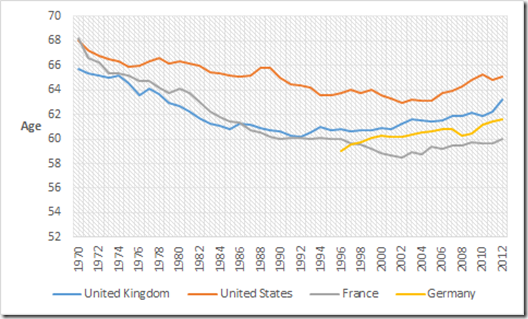

Figure 2 shows similar results for British and American women as for men in the same country shown in figure 1 . That is, falling effective retirement ages for both British and American women in the 1970s and 1980s followed by a slow climb again towards the end of 1990s. French effective retirement ages for women followed the same pattern as for French retirement ages for men – a long fall to below the age of 60 with a slight increase recently. The German retirement data suggest that effective retirement ages for German women is increasing.

Figure 2: average effective retirement age for women, USA, UK, France and Germany 1970 – 2012, (five-year average)

Source: OECD Pensions at a Glance.

24 Jul 2015

by Jim Rose

in business cycles, health and safety, human capital, labour economics, occupational choice, politics - New Zealand, politics - USA, poverty and inequality, welfare reform

Tags: adverse selection, disability insurance, moral hazard, social insurance, welfare state

24 Jul 2015

by Jim Rose

in economic history, labour economics, labour supply, politics - Australia, politics - New Zealand

Tags: ageing society, Australia, demographic crisis, economics of retirement, effective retirement ages, female labour force participation, female labour supply, male labour force participation, male labour supply, old age pensions, older workers, retirement ages, social insurance, Social Security, welfare state

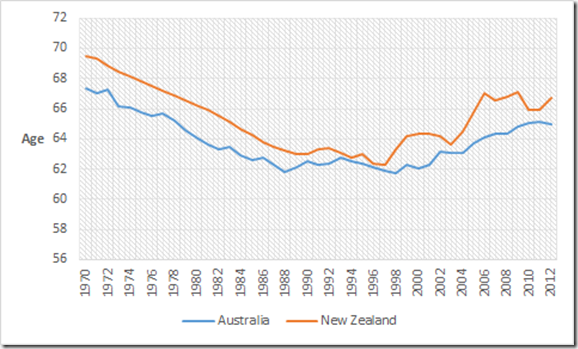

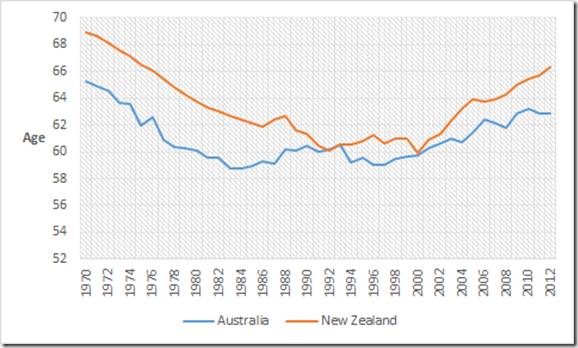

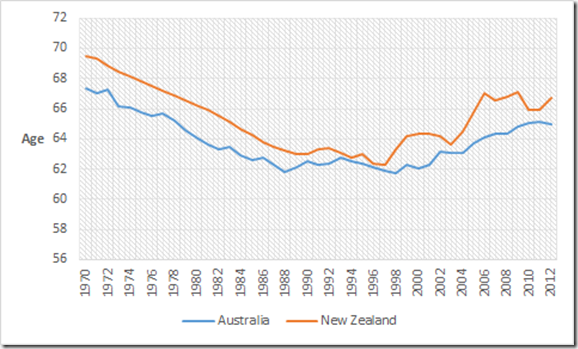

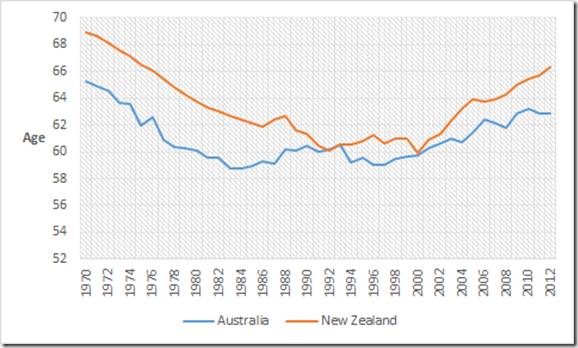

Figures 1 and 2 shows a sharp increase in the average effective retirement age for men and women in both Australia and New Zealand between 1970 and 1990. After that, retirement ages for men in both countries stabilised for about a decade. effective retirement age than Australia.

Figure 1: average effective retirement age for men, Australia and New Zealand, 1970 – 2012, (five-year average)

Source: OECD Pensions at a Glance.

Interestingly, in the 1970s and 1980s, New Zealand had an old-age pension scheme, known as New Zealand Superannuation, whose eligibility age was lowered from 65 to 60 in one shot in 1975. This old-age pension in New Zealand had no income test or assets test, but there was for a time a small surcharge on any income of pensioners. Nonetheless, New Zealand had a higher effective retirement age than in Australia where the old-age pension eligibility age is 65 with strict income and assets tests.

Figure 2: average effective retirement age for women, Australia and New Zealand, 1970 – 2012, (five-year average)

Source: OECD Pensions at a Glance.

Figure 1 and figure 2 also shows that the sharp increase in effective retirement ages in New Zealand for both men and women after the eligibility age for New Zealand’s old-age pension was increased from 60 to 65 over 10 years.

Figures 1 and 2 also show the gradual increase in effective retirement ages for Australian men and women from the end of the 1990s.

24 Jul 2015

by Jim Rose

in economics of love and marriage, labour economics, law and economics, poverty and inequality, welfare reform

Tags: economics of fertility, marriage and divorce, Population demographics, single mothers, single parents, social insurance, welfare state

23 Jul 2015

by Jim Rose

in economic history, gender, labour economics, labour supply

Tags: ageing society, British economy, demographic crisis, economics of retirement, effective retirement ages, female labour force participation, female labour supply, male labour force participation, male labour supply, old age pensions, older workers, retirement ages, social insurance, Social Security, welfare state

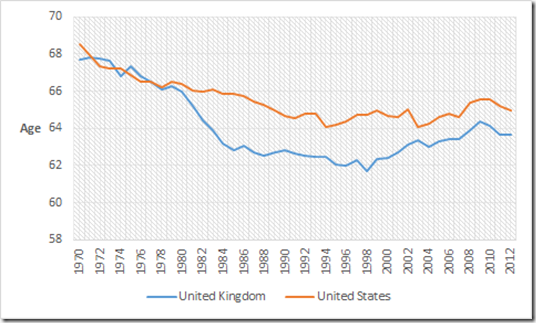

Figure 1 shows a divergence in the 1970s where there is a sharp increase in the average effective retirement age for men in the UK over a short decade. After that, British retirement ages for men started to climb again in the late 1990s. Figure 1 also shows that the gentle taper in the effective retirement age for American men stopped at the 1980s and started to climb again in the 2000s.

Figure 1: average effective retirement age for men, USA and UK, 1970 – 2012, (five-year average)

Source: OECD Pensions at a Glance.

Figure 2 shows similar results to figure 1 for British and American women. That is, falling effective retirement ages for both British and American women in the 1970s and 1980s followed by a slow climb again during the 1990s.

Figure 2: average effective retirement age for women, USA and UK, 1970 – 2012, (five-year average)

Source: OECD Pensions at a Glance.

17 Jul 2015

by Jim Rose

in labour economics, minimum wage, politics - Australia, politics - New Zealand, politics - USA, poverty and inequality, welfare reform

Tags: child poverty, family poverty, family tax credits, female labour force participation, in-work tax credits, single mothers, single parents, social insurance, welfare reform, welfare state

Previous Older Entries Next Newer Entries

![clip_image002[6] clip_image002[6]](https://utopiayouarestandinginit.com/wp-content/uploads/2015/08/clip_image0026_thumb.jpg?w=268&h=177)

Recent Comments