13 Nov 2015

by Jim Rose

in economics of love and marriage, labour supply, politics - Australia, politics - New Zealand, politics - USA

Tags: Australia, British economy, France, Ireland, Italy, maternal labour supply, single parents, sole parents, welfare state

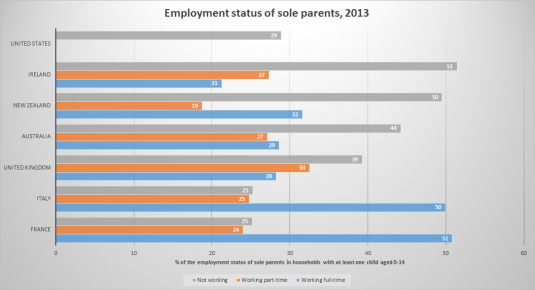

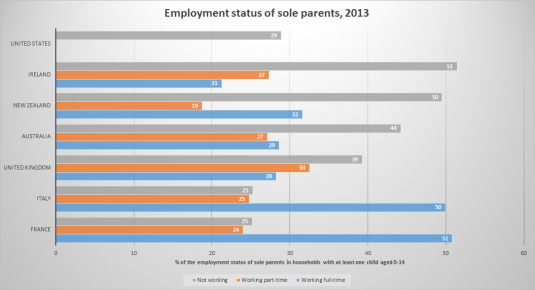

Despite supposedly having stingy welfare states, both New Zealand and Australia have a lot of sole parents who do not work at all. There is no separate breakdown of full-time and part-time work status in the USA. About 72% of sole parents in the USA either work full-time or part-time.

Source: OECD Family Database.

13 Nov 2015

by Jim Rose

in economic history, Euro crisis, labour economics, labour supply, macroeconomics, politics - USA, public economics

Tags: employment law, Eurosclerosis, France, Germany, growth of government, labour market regulation, size of government, taxation and labour supply

10 Nov 2015

by Jim Rose

in business cycles, economic history, economics of regulation, Euro crisis, job search and matching, labour economics, labour supply, macroeconomics

Tags: British economy, employment law, equilibrium unemployment rate, Eurosclerosis, France, Germany, Italy, labour market reforms, Margaret Thatcher, Thatchernomics, The British Disease

Unlike the USA, the German, Italian, British and French equilibrium unemployment rates all show fluctuations that reflect changes in their underlying economic circumstances and labour market reforms. The case of the British, the rise of the British disease and Thatchernomics. The case of German, its equilibrium unemployment rate rose after German unification and then fell after the labour market reforms of 2002 to 2005.

Source: OECD Economic Outlook November 2015 Data extracted on 10 Nov 2015 07:07 UTC (GMT) from OECD.Stat.

03 Nov 2015

by Jim Rose

in applied price theory, applied welfare economics, economic history, entrepreneurship, industrial organisation, labour economics, labour supply, Milton Friedman, poverty and inequality, Public Choice, rentseeking, unions

Tags: Canada, entrepreneurial alertness, France, Italy, top 1%, union power, union wage premium

The French ruling class is as lazy as their transnational co-conspirators down under. French union membership is in serious decline albeit from a low base. An opportunity lost for the French ruling class. It has not lifted a finger to extract additional labour surplus from the downtrodden French proletariat now stripped of their only line of collective defence against capitalist exploitation.

Source: OECD Stat and Top Incomes Database.

The top 10% and top 1% in France are no better off than two generations ago despite the decline of French unions. The French Left must be most disappointed. No kicking in the rotten door of the permanent revolution anytime soon after the immiserised French proletariat rises up because it has nothing to lose but its chains. The 21st century version of the Marxist call to the barricades would be a proletariat stirred to revolution with nothing to lose but their suburban home, motorcar, IPad and air points

Source: OECD Stat and Top Incomes Database.

The Italian ruling class has had little success in bringing Italian unions down. The top 10% in Italy is earning no more now than back when the Red Brigades were gunning for them.

Source: OECD Stat and Top Incomes Database.

The top 1% in Italy is doing a little bit better than when the Red Brigade was gunning for them, but not much more. Unions don’t figure in explaining that small rise in Italian top 1% incomes over the last 40 years. Italian unions are pretty much a strong as they were 40 years ago in membership. Italian employment protection laws are pretty much as strong as they used to be too.

Source: OECD Stat and Top Incomes Database.

The Canadian ruling classes even more incompetent than their transnational co-conspirators over in Italy. There appears to have been next to no decline in union membership in Canada. The Canadian top 10% is not earning any more than back in the 60s.

Source: OECD Stat and Top Incomes Database.

The Canadian top 1% is doing a little bit better than 25 years ago also but not off the back of unions which are almost as strong as in the past. The Canadian Left will have to look for a different hypothesis than the ravages of the top 1%.

Source: OECD Stat and Top Incomes Database.

All in all, the Economic Policy Institute simply got lucky with a spurious correlation between top incomes and union membership in the USA.

19 Oct 2015

by Jim Rose

in applied price theory, applied welfare economics, economic history, economics of regulation, rentseeking, urban economics

Tags: France, Germany, housing affordability, housing prices, Italy, land supply, land use planning, zoning

Source and notes: International House Price Database – Dallas Fed June 2015; nominal housing prices for each country is deflated by the personal consumption deflator for that country.

14 Sep 2015

by Jim Rose

in economic history, urban economics

Tags: France, Generation Rent, Germany, housing affordability, housing prices, Italy, land supply, land use planning, NIMBYs, zoning

Source: International House Price Database – Dallas Fed

Note: The house price index series is an index constructed with nominal house price data. The real house price index is an index calculated by deflating the nominal house price series with a country’s personal consumption expenditure deflator.

19 Aug 2015

by Jim Rose

in economics of religion, gender, human capital, labour economics, labour supply, occupational choice, poverty and inequality, welfare reform

Tags: female labour force participation, female labour supply, France, gender gap, Germany, Greece, Italy, Portugal, Spain, Turkey

14 Aug 2015

by Jim Rose

in currency unions, Euro crisis, job search and matching, labour economics, labour supply, macroeconomics, unemployment

Tags: British economy, equilibrium unemployment rate, France, Germany, long-term unemployment, natural unemployment rate, social insurance, unemployment duration, unemployment insurance, welfare state

As the British labour market and long-term unemployment was starting to get something like that in the USA, the USA started to have unemployment it was more like the European labour markets in terms of the number of long-term unemployed. Nothing much happened in Germany and France.

Source: OECD StatExtract.

14 Aug 2015

by Jim Rose

in economic history, Euro crisis, labour economics, unions, urban economics

Tags: Eurosclerosis, France, German unification, Germany, Italy, union membership, union power, union wage premium

There are large differences in unionisation rates between the three countries. France has always had low levels of unionisation which halved since the 1970s. Italy had a sharp boost in union membership in the number of unions in the 1960s and 70s. This may have been associated with increased urbanisation. Union membership rate stayed pretty high in Italy ever since with a small taper downwards. Germany had stable unionisation rates prior to German unification after which the numbers about halved up in a slow taper.

Source: OECD Stat Extract.

10 Aug 2015

by Jim Rose

in applied price theory, applied welfare economics, comparative institutional analysis, currency unions, economic growth, economic history, economics of regulation, entrepreneurship, Euro crisis, fiscal policy, global financial crisis (GFC), income redistribution, labour economics, labour supply, macroeconomics, Marxist economics, poverty and inequality, Public Choice, public economics, rentseeking

Tags: British disease, entrepreneurial alertness, Eurosclerosis, France, German unification, Germany, growth of government, sick man of Europe, social insurance, Sweden, taxation and entrepreneurship, taxation and investment, taxation and labour supply, welfare state

The Washington Centre for Equitable Growth recently tweeted that inequality harms growth in the USA as compared to Sweden, France, Germany and the UK. It was relying on some dodgy OECD research.

The Washington Centre for Equitable Growth did not check their inequality ratios they tweeted against trends in economic growth and economic policy since 1970, which I have reproduced in figure 1. Germany is not included in figure 1 because German data on growth is thrown askew by German unification.

Figure 1: Real GDP per British, French and Swede aged 15-64, 2014 US$ (converted to 2014 price level with updated 2011 PPPs), 1.9 per cent detrended, 1970-2013

Source: Computed from OECD Stat Extract and The Conference Board. 2015. The Conference Board Total Economy Database™, May 2015, http://www.conference-board.org/data/economydatabase/

Figure 1 shows that France has been in a long-term decline since the late 1970s despite the blessings of a more equal society than the USA as championed by the Washington Centre for Equitable Growth. In figure 1, a flat line is growth in real GDP per working age person, PPP, at the same rate as the USA for the 20th century, which was 1.9% per year. A falling line in figure 1 indicates growth of less than 1.9% while a rising line indicates growth in real GDP per working age person, PPP, in excess of 1.9%. In figure 1, France hardly ever grew at the trend rate of growth for the USA of 1.9% per year and was frequently well below that rate.

Sweden tells a slightly different story in figure 1 because of regime change in the early 1990s when Sweden adopted more liberal economic policies where taxes and government spending were reduced:

The rapid growth of the state in the late 1960s and 1970s led to a large decline in Sweden’s relative economic performance. In 1975, Sweden was the 4th richest industrialised country in terms of GDP per head. By 1993, it had fallen to 14th.

That regime change reversed a long economic decline since 1970 under the egalitarian policies of the Swedish Social Democratic Party. Under the Swedish Social Democratic Party, Sweden was almost always growing at less than the trend rate of growth of the USA, which was 1.9%. That position reversed only when there was a turn away from big government and high taxes.

Figure 1 tells a similar story for the British economy: a long economic decline in the 1970s when Britain was the sick man of Europe. Under Thatchernomics, Europe had a long economic boom for 20 years or more – see figure 1.

In the 1970s, under the high taxes of the Heath, Callaghan and Wilson administrations, as figure 1 shows, Britain was the sick man of Europe. With the election of the Thatcher Government, Britain soon grew at better than the US trend growth rate for nearly 20 years through few exceptions.

05 Aug 2015

by Jim Rose

in economic history, Euro crisis, job search and matching, labour economics, labour supply, macroeconomics, unemployment

Tags: employment law, equilibrium unemployment rate, France, labour market regulation, natural unemployment rate, unemployment duration

Nothing really changes in France recently unemployment duration. Italian labour market is notorious for having very low inflows and outflows from employment and unemployment.

Source: OECD StatExtract.

05 Aug 2015

by Jim Rose

in discrimination, economic history, gender, labour economics, law and economics

Tags: France, gender wage gap, Germany, Leftover Left, Norway, Sweden, Twitter left

Our friends on the Left go on about how wonderful place Sweden is despite its gender gap being stuck for 35 years. Not much better in Norway and in Germany and France for that matter.

Figure 1: gender wage, % of median male wage, full-time employees, France, Germany, Sweden and Norway, 1980 – 2012

Source: Earnings and wages – Gender wage gap – OECD Data.

The gender wage gap in figure 1 is unadjusted and defined as the difference between median earnings of men and women relative to median earnings of men. Data refer to full-time employees.

Previous Older Entries Next Newer Entries

Recent Comments