Explanation of the Greece Bailout in 90 Seconds

13 Aug 2015 Leave a comment

in budget deficits, business cycles, currency unions, economic growth, fiscal policy, international economic law, international economics, International law, macroeconomics Tags: credible commitments, Eurosclerosis, game theory, Greece, sovereign bailouts, sovereign defaults

Greece’s GDP collapse is among the worst advanced economy falls since 1870

07 Aug 2015 Leave a comment

in currency unions, economic growth, economic history, Euro crisis, macroeconomics Tags: Eurosclerosis, Greece, prosperity and depression

Greece's GDP collapse is among the worst advanced economy falls since 1870. And most of those were war-related. http://t.co/QLp6fYN83u—

RBS Economics (@RBS_Economics) July 04, 2015

Swedosclerosis, Eurosclerosis and the British disease compared

05 Aug 2015 2 Comments

in currency unions, economic growth, economic history, economics of regulation, Euro crisis, fiscal policy Tags: British disease, British economy, Eurosclerosis, France, Germany, Italy, sick man of Europe, Sweden, Swedosclerosis

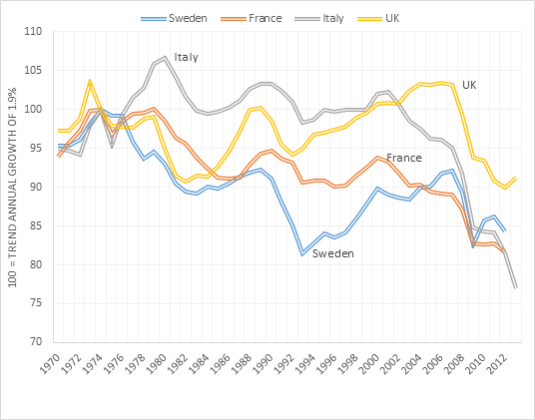

Figure 1 shows stark differences between Sweden, France, Italy and the UK since 1970 in departures from trend growth rates of 1.9% in real GDP per working age person, PPP. Italy did quite OK until 2000 growing at about the trend growth rate of 1.9% after which it fell into a hole so deep that it barely notice the onset of the global financial crisis. Sweden really had been the sick man of Europe until it turned its back on high taxing, welfare state socialism in the early 1990s. France has been in a long decline so much so that the global financial crisis is hard to pick up in the acceleration in its long decline in the mid-1990s. Figure 1 also shows Britain did very well, both under the neoliberal horrors of Thatcherism and the betrayals by Tony Blair of a true Labour Party platform. The UK grew at above the trend annual growth to 1.9% for most of the period from the early 1980s to 2007. The UK has done not so well since the onset of the global financial crisis.

Figure 1: Real GDP per Swede, French, British and Italian aged 15-64, 2014 US$ (converted to 2014 price level with updated 2011 PPPs), 1.9 per cent detrended, 1970-2013

Source: Computed from OECD StatExtract and The Conference Board. 2015. The Conference Board Total Economy Database™, May 2015, http://www.conference-board.org/data/economydatabase/

Note: When the line is flat, the economy is growing at its trend annual growth rate. A falling line means below trend annual growth; a rising line means of above trend annual growth. Detrended with values used by Edward Prescott.

German data was not in figure 1 because German unification threw all of its data into disarray for long-term comparison purposes.

Did fiscal austerity in 2010 have credible academic support?

05 Aug 2015 1 Comment

#Greece austerity gauge. Greek government spending has fallen 20% since 2008. In UK and Italy it's up. #GreekCrisis http://t.co/WMQBxxVFqq—

RBS Economics (@RBS_Economics) July 07, 2015

One measure of the scale of austerity in Greece…and other advanced economies. http://t.co/PxCLagdd3L—

RBS Economics (@RBS_Economics) July 06, 2015

The employment level in #Greece is back to where it was in 1985. It's the equivalent of the UK losing 6 million jobs. http://t.co/AAWHMEFwfK—

RBS Economics (@RBS_Economics) July 06, 2015

Did the GFC catch modern macroeconomists by surprise?

03 Aug 2015 Leave a comment

in budget deficits, business cycles, currency unions, economic growth, Euro crisis, fiscal policy, global financial crisis (GFC), great depression, great recession, history of economic thought, law and economics, macroeconomics, monetary economics Tags: bank panics, bank runs, banking crises, currency crises, Thomas Sargent

Italy compared to Greece – bust without the boom

31 Jul 2015 1 Comment

in business cycles, currency unions, economic growth, economic history, Euro crisis, global financial crisis (GFC), macroeconomics Tags: Eurosclerosis, Greece, Italy, sovereign defaults

Are there net saving from a British pull-out of the EU?

31 Jul 2015 Leave a comment

in currency unions, economic growth, Euro crisis, international economics, macroeconomics Tags: British economy, customs unions, EU, EU membership, free trade areas, international economic integration, preferential trading agreements, regional integration

Ukip claims that there is a net saving from pulling out of EU are highly debatable: http://t.co/TemtNC9gnN—

C4 News FactCheck (@FactCheck) April 02, 2015

Unemployment rates across the OECD member countries

30 Jul 2015 Leave a comment

in business cycles, currency unions, economic growth, Euro crisis, job search and matching, labour economics, labour supply, macroeconomics, unemployment Tags: employment law, employment regulation, EU, Euro sclerosis, Euroland, Eurosclerosis, Japan, labour market regulation

European integration explained in one easy chart

25 Jul 2015 Leave a comment

in currency unions, Euro crisis, international economics, macroeconomics Tags: Common market, customs unions, economics of immigration, EU, Euro, Euroland, European free trade area, European Union, free trade agreements, free trade areas, open borders, preferential trading agreements

AMAZING chart on European integration. One to pin to your office wall. Nice job by @Nic_Koenig delorsinstitut.de/2015/wp-conten… http://t.co/zZbOA29mYP—

Maxime Sbaihi (@MxSba) July 24, 2015

Is the socialist solution to the Greek economic crisis working?

25 Jul 2015 Leave a comment

in budget deficits, business cycles, currency unions, economic growth, Euro crisis, fiscal policy, global financial crisis (GFC), international economics, law and economics, macroeconomics, monetary economics, property rights Tags: capital controls, capital flight, Greece, labour exodus, sovereign defaults

For down and out Greeks, the U.K. is the promised land with jobs aplenty bloom.bg/1Lwcc55 http://t.co/XHHXxdTUiN—

Bloomberg Business (@business) July 24, 2015

Finland is the poster child for why the euro doesn’t work

24 Jul 2015 Leave a comment

in business cycles, currency unions, economic growth, Euro crisis, global financial crisis (GFC), macroeconomics Tags: Euro land, Finland, recessions and recoveries, Sweden

Iceland went bankrupt in 2008

23 Jul 2015 Leave a comment

in currency unions, economic growth, Euro crisis, fiscal policy, macroeconomics Tags: Euroland, Eurosclerosis, Finland, Iceland, sovereign default, The Netherlands

Finland and Holland have grown less than Iceland since 2007. Iceland went bankrupt in 2008. washingtonpost.com/blogs/wonkblog… http://t.co/gBEbDUhgYS—

Matt O'Brien (@ObsoleteDogma) July 17, 2015

Maggie Thatcher on the Greek crisis

17 Jul 2015 Leave a comment

in applied welfare economics, budget deficits, comparative institutional analysis, constitutional political economy, currency unions, economic growth, economic history, economics of regulation, Euro crisis, fiscal policy, income redistribution, macroeconomics, Marxist economics, Public Choice, rentseeking Tags: Greece, growth of government, Margaret Thatcher, size of government

Recent Comments